Turning Your Target Audience Into Defined Personas

Imagine trying to market financial planning software without really understanding who you’re talking to. It’s like throwing darts blindfolded—you might hit the target, but it’s mostly luck. That’s why defining your audience as specific personas is a game-changer.

For financial advisors, personas are especially important. Clients seeking financial advice vary widely in their needs, goals, and preferences. Some are young professionals looking to build wealth, while others are retirees focused on preserving it. By creating well-defined personas, you can tailor your services and messaging to attract and retain the right clients.

Here’s how to turn your broad target audience into detailed personas that will supercharge your marketing strategy.

Step 1: Understand the Difference Between a Target Audience and a Persona

Your target audience is the broad group of people who could benefit from your services. For example:

Target Audience: Individuals aged 30–60 looking for wealth management and retirement planning.

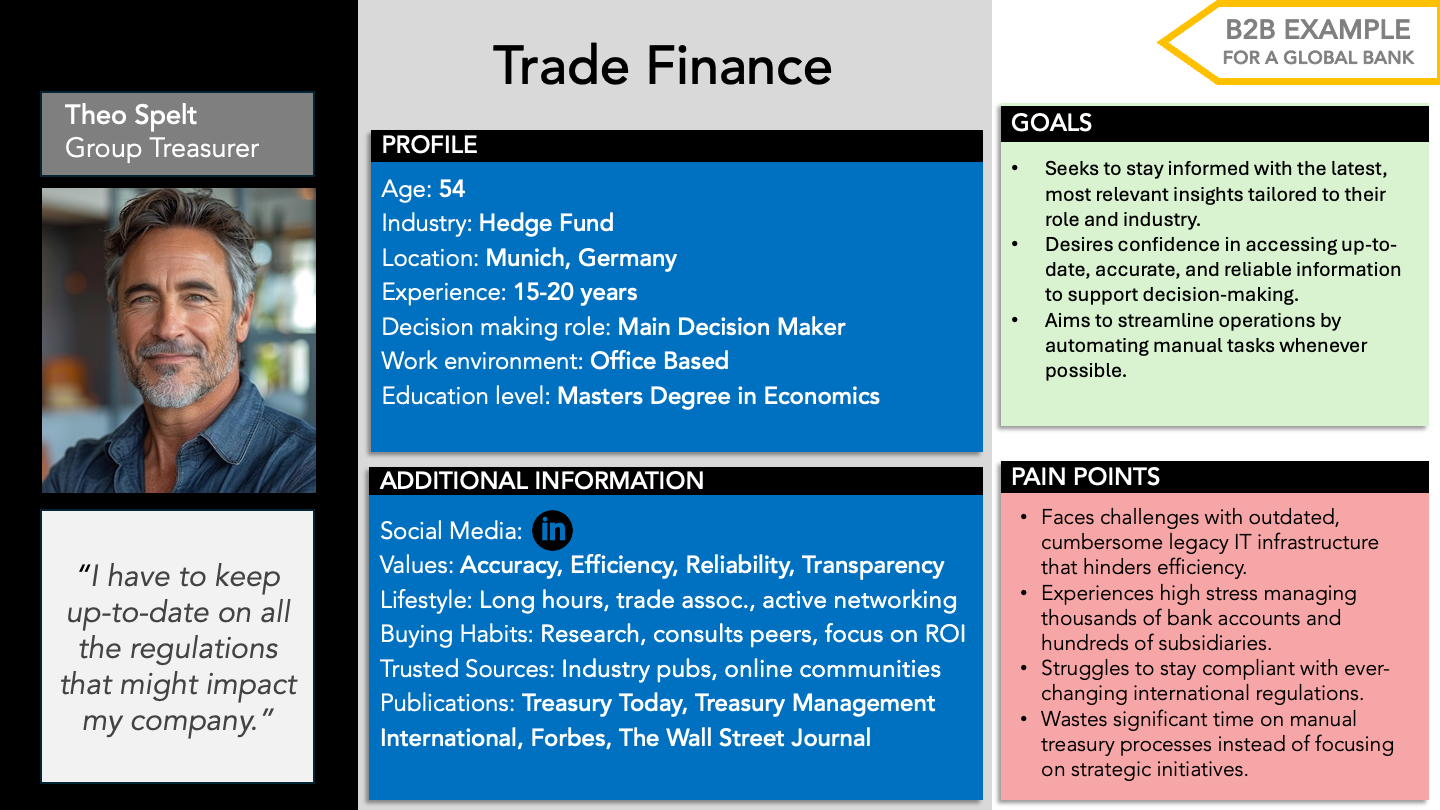

A persona is a deeper dive—it’s a semi-fictional profile based on real data and insights. Personas bring your target audience to life by capturing specific details about their demographics, goals, challenges, and preferences.

Example Persona: “Retirement-Ready Rachel,” a 58-year-old teacher with $500K in savings who wants to maximize her retirement income and ensure her investments align with her values.

Personas help you go from generic marketing to personalized, targeted strategies.

Step 2: Gather Data About Your Clients

To create accurate personas, start by collecting data about your existing and potential clients. The more you know, the more precise and effective your personas will be.

1. Analyze Your Current Client Base

Dive into the details of your current clients to identify patterns and commonalities.

Demographics: Age, occupation, income, marital status, location.

Financial Goals: Saving for retirement, building wealth, estate planning, minimizing taxes.

Challenges: Confusion about investment options, fear of outliving their savings, balancing college funds with retirement planning.

Tools to Use:

CRM Software: Track client demographics, services used, and engagement history.

Financial Planning Tools: Analyze common trends in financial goals or investment preferences.

Social Media Insights: Learn more about your clients’ interests and behaviors.

2. Conduct Surveys and Interviews

Go straight to your clients or prospects to learn about their financial goals, concerns, and preferences.

Questions to Ask:

What’s your biggest financial goal right now?

What’s your biggest concern when it comes to money?

How do you prefer to learn about financial options (e.g., online research, in-person meetings)?

Why did you choose our firm, or what are you looking for in a financial advisor?

Pro Tip: Use incentives like free consultations or financial planning resources to encourage participation.

3. Leverage Market Research

If you’re targeting a new audience or want a broader perspective, tap into industry research to understand financial trends and audience behaviors.

Tools to Try:

Pew Research Center: For demographic insights.

Investment and Wealth Institute: For industry-specific data.

U.S. Census Data: To understand regional income and financial habits.

4. Monitor Online Conversations

Online forums, social media, and reviews can provide unfiltered insights into your audience’s financial concerns and decision-making processes.

Where to Look:

Social Media: Comments on posts related to wealth management or financial planning.

Review Sites: Feedback on financial services competitors.

Forums: Platforms like Reddit’s personal finance community can reveal common questions and pain points.

Step 3: Identify Common Patterns and Group Your Audience

Once you’ve collected data, look for patterns and group your clients into 3–5 distinct personas based on shared characteristics, financial goals, and challenges.

Example Persona Groups for Financial Advisors:

Young Professionals Building Wealth: Ages 25–35, tech-savvy, focused on paying off debt and starting investments.

Family-Focused Parents: Ages 35–50, balancing saving for college, retirement, and managing mortgages.

Pre-Retirees: Ages 50–60, seeking to maximize savings, reduce taxes, and plan for a secure retirement.

Retirees: Ages 60+, focused on preserving wealth, managing healthcare costs, and leaving a legacy.

Step 4: Create Detailed Persona Profiles

Bring each persona to life with a detailed profile that captures who they are, what they need, and how you can help.

Step 5: Use Personas to Guide Your Marketing Strategy

Once you’ve created your personas, use them to shape every aspect of your marketing and service delivery.

Content Creation: Write blogs, create webinars, or develop guides tailored to each persona. For example, “5 Ways Pre-Retirees Can Maximize Their Savings” for Retirement-Ready Rachel.

Messaging: Use language and tone that resonate with each persona. For example, young professionals may appreciate casual, tech-savvy messaging, while retirees may prefer a professional, empathetic tone.

Channel Selection: Focus on the platforms where your personas spend their time. For instance, young professionals might be active on LinkedIn, while retirees may prefer email newsletters or in-person events.

Service Offerings: Design services or packages that align with the needs of your personas. For example, offer tax-efficient retirement planning for pre-retirees or financial literacy workshops for young professionals.

Step 6: Revisit and Refine Your Personas

Your audience’s needs and goals may change over time, especially in the financial industry. Revisit your personas regularly—quarterly or annually—to update them based on new client insights or market trends.

Final Thoughts

Defining personas transforms your marketing from generic to highly targeted, helping you connect with clients on a deeper level. For financial advisors, it’s the key to understanding your audience’s unique financial goals, challenges, and motivations—and delivering services that truly meet their needs.

By turning your broad target audience into actionable personas, you’ll create a more personalized client experience, build stronger relationships, and ultimately grow your business.